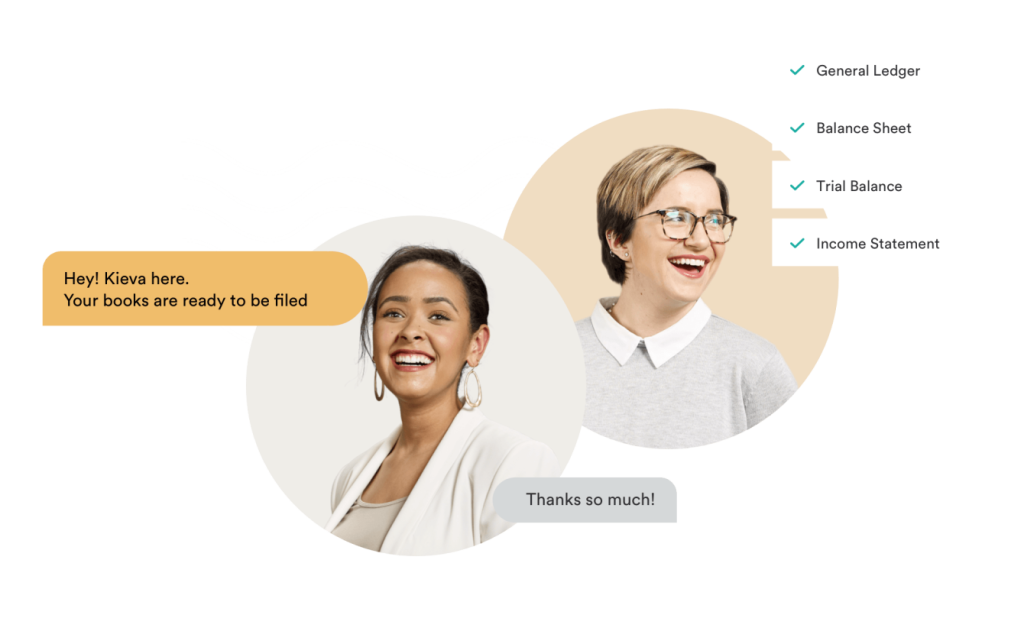

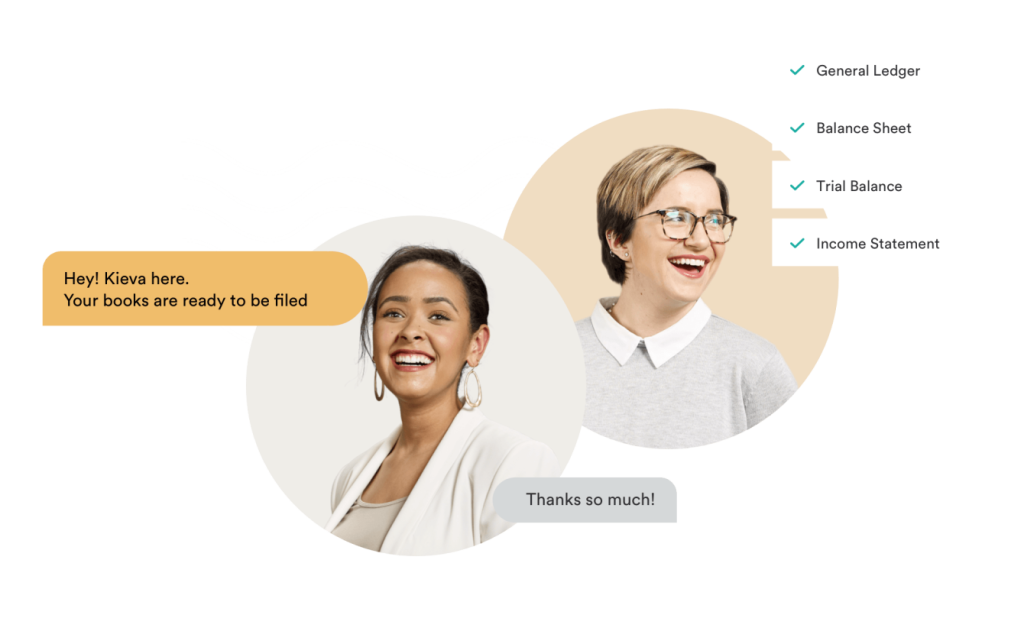

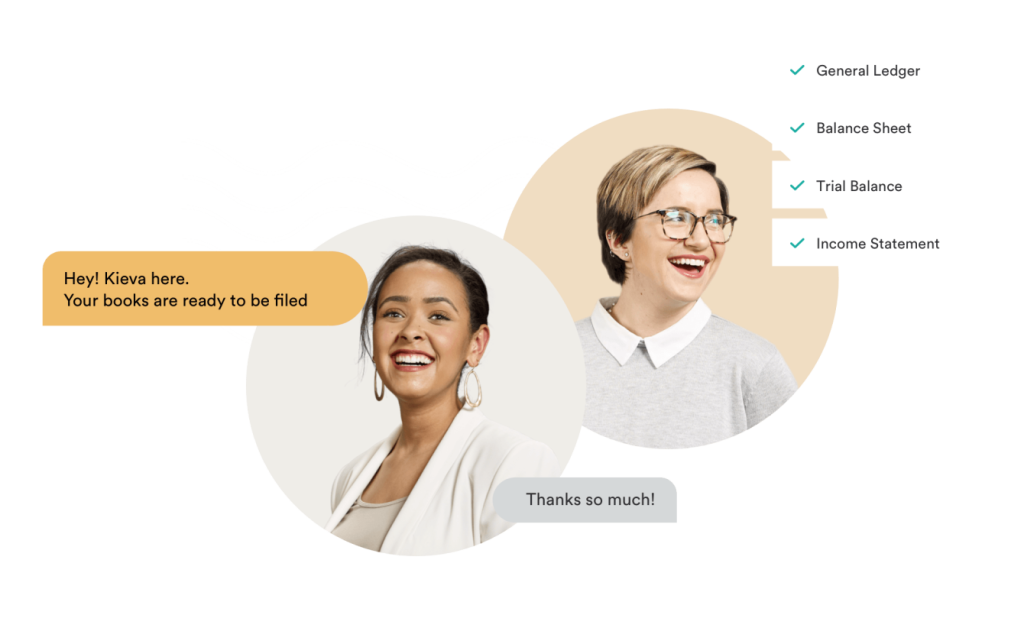

When you live or work outside the norms of society, it’s good to know there’s an Accountant that has your back. We’ve created a space where you can speak openly and honestly about your finances regardless of your occupation.

Our team of qualified Accountants are here to help you with all your Accounting, Taxation, and bookkeeping needs.

We’ll consider your personal and business situation, and we’ll help you set up your finances in a way that keeps your business yours – discrete, confidential (‘mum’s the word’) – while helping you get set up for financial security and, ultimately, success.

If you aren’t registered for GST but run a business and pay yourself, you’ll need to lodge an Instalment Activity Statement (IAS).

Do you hate the paperwork, and do the numbers do your head in? No worries. Katrina and the team can guide you.

If you run a business and are registered for GST, you will need to file a quarterly Business Activity Statement or BAS with the ATO. BAS enables a registered business entity in Australia to report on their tax obligations with the tax office, and they include your Pay-As-You-Go-Withholding (PAYGW), better known as employee income tax, your Pay-As-You-Go-Instalments (PAYGI – your income tax), your GST and fringe benefits tax (FBT) if you have any.

Katrina and the team will guide you.

Whether you are registered for GST or not, you still need to keep track of the GST you are paying as you can claim it back.

If your business has a turnover of $75K or more (minus GST), you need to be registered for GST. If not, you can choose to register. Once registered, you must supply customers with an invoice with 10% GST. You will need to report on your GST and claim GST from your expenses in your (usually quarterly but sometimes monthly) Business Activity Statement or BAS. There are different ways to report on your GST depending on your business size.

Why are we telling you this? You need to understand your tax obligations… but thankfully, you don’t have to go it alone. We’re here to FIGURE IT OUT and guide you. Too easy!

We have three offices conveniently located in Sydney, Melbourne and Brisbane.

We sure are. We know how to set up your books and paperwork so that what you do stays confidential while meeting all your reporting, tax, and accounting obligations with the Australian Taxation Office. We’ve worked hard to create a safe space where you can feel comfortable talking about money frankly – we get you, we get your work, and we get how to help you make it all work above board for the ATO.

An Instalment Activity Statement or IAS is lodged monthly by businesses that are not registered for GST or businesses who have more than $25K in Pay-As-You-Go withholdings (PAYGW) each month. A Business Activity Statement (BAS) is usually lodged quarterly but sometimes monthly by businesses that are registered for GST.

Sure can. It may surprise you to hear that one of the hats Katrina wears is that of Home Mortgage and Motor Vehicle Broker. She wants to make sure everyone has the opportunity to get a property! She can assist you with purchasing a home, talk about negative gearing, capital gains tax, refinancing, or even buy a new car.

Sure can. Over the years, Katrina has built up her little black book of contacts that will support you. She can refer you to solicitors, financial planners and financial institutions that will support you.

Sure can. Our team will help you get set up for success from day one (and if you’ve already started your business but want to streamline things, we’re here for that too). We can help you with budgeting and simplifying your taxation decisions and help you understand your obligations (and how we can make that easy for you, of course). Just Give Figure It Out a call or book a date with us – we’ll take it from there. We’ll chat figures over bubbles, mineral water (or beer) in a safe environment where you can be you, no strings attached.

Tax and accounting regulations in Australia change from time to time. We recommend seeking professional advice from a qualified Accountant or Taxation Agent for specific guidance tailored to your circumstances.

Katrina has been involved in working parties within the Australian Taxation Office, so she knows what specific deductions you can claim. She’s here to take the pressure off, so you don’t get stressed or worry … that’s her job!

Give Figure It Out a call, and we’ll answer your questions based on your personal circumstances.